Leaders operate in the face of constant and rapid change today, tasked with guiding their workforce through unprecedented shifts. This reality is underscored by PwC's 2024 Global Workforce Hopes and Fears Survey, which reveals that employees are navigating significant transformations influenced by

Can AI Make You a Better Leader?

Executive Summary: Artificial Intelligence (AI) has often been viewed with skepticism when it comes to its role in leadership. However, my recent research reveals that AI can be a powerful tool in enhancing human leadership, making leaders not just more efficient but also more empathetic and wise.

Transparency and Openness: Keys to Fostering a Culture of Well-Being

Executive Summary: Well-being is a critical factor for employee engagement, productivity, and retention. However, many organizations struggle to cultivate a culture that truly prioritizes and supports holistic wellness. Why? Two key ingredients for success are transparency and open communication

The Great Resignation and the Role of Well-Being in Executive Retention

Executive Summary: The Great Resignation disrupted workforces across industries, with many talented employees leaving their roles in pursuit of better opportunities. However, with this event in the rearview mirror we can recognize that this phenomenon was not limited to rank-and-file workers –

The Importance of Health-Savvy Leadership for Employee Well-Being

Executive Summary: The well-being of employees has become a critical factor for organizational success. However, many leaders struggle to prioritize and promote holistic well-being effectively. The concept of "Health-Savvy Leadership" offers a path forward, emphasizing the importance of executives

The Role of Work in Hindering Employee Well-Being

Executive Summary: The demands of modern work often directly conflict with employees' ability to prioritize their overall well-being. Deloitte's research reveals that heavy workloads, long hours, and an inability to disconnect from work are major obstacles preventing employees from engaging in

Well-Being: The Disconnect Between Executives and Employees

Executive Summary: Research conducted by Deloitte reveals a striking disconnect between executives and employees when it comes to perceptions of well-being in the workplace. While the vast majority of executives believe their employees are thriving in all aspects of well-being, a significant

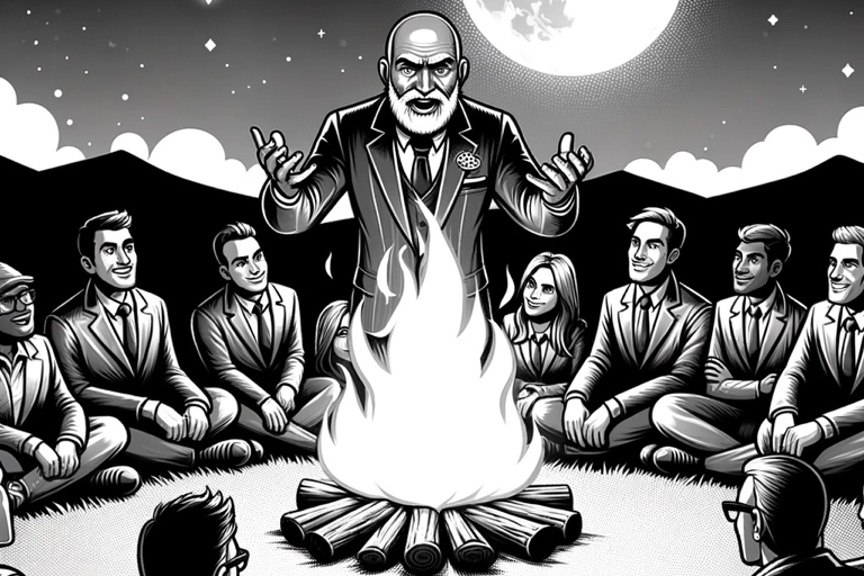

Storytelling and Leadership: A Case Study

As a follow up and supplement to our recent article titled, "Storytelling and Leadership" we present the following case study. As previously shared, storytelling emerges as a vital tool, not just for communication, but as a fundamental aspect of effective leadership. Sam Palazzolo, Principal Officer

Storytelling and Leadership

Storytelling emerges as a vital tool, not just for communication, but as a fundamental aspect of effective leadership. Sam Palazzolo, Principal Officer at the Javelin Institute, explores the nuanced relationship between storytelling and leadership. He proposes that storytelling transcends the mere